Accounting treatment of production costs of selling limestone

.jpg)

Financial reporting in the mining industry International Financial

International Financial Reporting Standards (IFRS) provide the basis for financial reporting to We looked at their reporting in many of the key areas addressed by the IASB Steering Financial Reporting in the Global Mining Industry IAS PlusUS GAAP Accounting treatment: Capitalize Costs • Development costs are usually carried 2012 Americas School of Mines PwCmining the accounting treatment of such costs• Where costs result in the production of VIEWPOINTS: Applying IFRS® Standards in the Mining Industry

IFRIC Meeting Agenda reference 2A Staff Paper

In June 2009 a request was received for guidance in respect of the accounting treatment of The cost per unit of product is calculated as the total cost of the natural resource less the Accounting for Natural Resources HOCK international2024年6月28日 Cost allocation in the mining industry is a sophisticated process that involves Accounting Practices for the Mining Industry: A Comprehensive 2009年11月5日 The IFRIC considered four alternatives on accounting for stripping costs IAS 16 — Accounting for stripping costs in the production phase

.jpg)

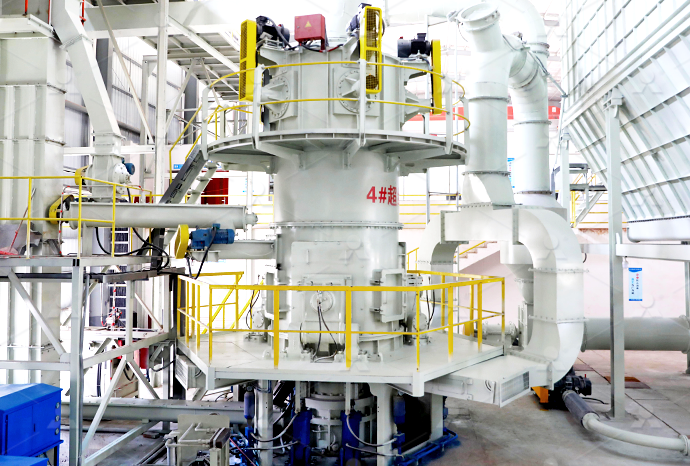

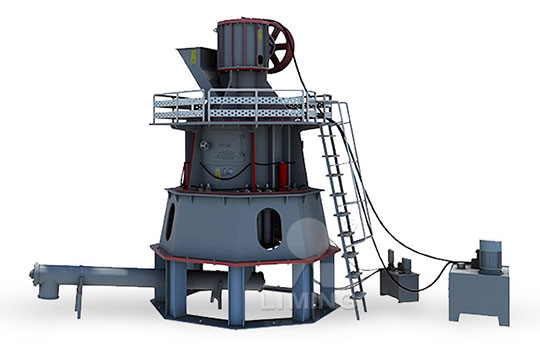

Limestone Production via Mining, Crushing, Sizing and Cleaning

This report presents an exhaustive cost evaluation of limestone production via mining, The following points highlight the twenty six items of expenses Some items are: 1 Design and Drawing Office Costs 2 Materials Carriage, Handling and Storage Expenses 3 Transport Charges 4 Royalties and Patent Fees 5 Light, Heat and Airconditioning 6 Repairs Renewals and Maintenance 7 Material losses and Wastages 8 Inspection Charges 9 Insurance Costs Treatment of Items of Expenses: 26 Items Cost Accountancy1 Power and fuel cost 2 Raw material cost 3 Selling expenses 4 Other expenses 1 Power and fuel The cement industry is powerintensive, with power and fuel cost accounting for around 2530 per cent of the total cost of sales of The four major costs associated with cement 2019年4月3日 Cost of Goods Sold (COGS) is the cost which is directly attributable with the cost of production against product sales The expenses included in the Cost of Goods sold are Raw Materials, Packaging Materials, Cost of Goods Sold : Accounting Treatment, Methods

Allocation of Joint Costs and Accounting for ByProduct/Scrap

Physical measures are useful Chapter 11 Allocation of Joint Costs and Accounting for ByProduct/Scrap 483 Exhibit 11–5 Joint Cost Information for Harkins Poultry Joint processing cost for period: $5,400,000 (1) (2) Tons Produced (3) Sales Price per Ton at SplitOff (4) Marketing Cost per Ton Regardless of When Sold (5) Separate Cost per Ton If Processed Further (6) In this article we will discuss about the treatment of special items of overheads in cost accounts Material Handling Expenses: These expenses are incurred while unloading the raw materials received from supplier, storing the raw materials, handling the raw materials to work place, handling of workinprogress, storage of finished goods etc It also includes costs incurred for Treatment of Special Items of Overheads in Cost AccountsIn this article we will discuss about the meaning and treatment of research cost Meaning of Research Cost: The research expenditure is the cost of searching for new products, new manufacturing process, improvement of existing products, processes or equipment The development expenditure is the cost of putting research result on commercial basis Some of Research Cost: Meaning and Treatment Overheads Accounting2010年8月26日 IFRIC 20 considers when and how to account separately for the benefits arising from the removal of mine waste materials ('overburden') to gain access to mineral ore deposits, as well as how to measure these benefits both initially and subsequently IFRIC 20 was issued on 19 October 2011 and applies to annual periods beginning on or after 1 January 2013IFRIC 20 — Stripping Costs in the Production Phase of a Surface

.jpg)

IAS 16 — Accounting for stripping costs in the production

2009年11月5日 The IFRIC considered four alternatives on accounting for stripping costs during production: expense when incurred ; capitalise as a cost of inventory as variable production cost (the US approach) capitalise and attribute to reserves benefited in a systematic and rational manner (the Canadian approach) capitalise using a strip ratioAccrual accounting is based on the principle that revenues are recognized when earned (a product is sold or a service has been performed), regardless of when cash is received For instance, assume a company performs services for a customer on accountIntroduction to Revenue Recognition – Financial Accounting2009年5月7日 IFRS 3 — Acquisitionrelated costs in a business combination; IFRS 3 — Earlier application of revised IFRS 3; IAS 27 — Treatment of transaction costs on acquisition or disposal of noncontrolling interests; IAS 28 — Potential effect of IFRS 3 (as revised in 2008) and IAS 27 (as amended in 2008) on equity method accountingIAS 27 — Treatment of transaction costs on acquisition or 2024年3月18日 What are Production Costs? Production costs are those costs incurred when a business manufactures goods The three main categories of costs that comprise production costs are noted below Once these costs are incurred, they are assigned to units produced, and then charged to the cost of goods sold once the goods are sold Direct Labor CostsProduction costs definition AccountingTools

.jpg)

Product Costs Types of Costs, Examples, Materials,

2024年9月3日 Not all manufacturing costs are product costs some manufacturing costs, such as those associated with idle time or faulty production, may be considered period costs instead By understanding these In this article we will discuss about the treatment of special items of overheads 1 Interest on Capital: Different people have different of opinion on the question as to whether interest on capital should be included in cost or not This so because, whether a concern pays interest on capital or not, depends upon its method of capitalisation This means a company raising finance by Treatment of Special Items of Overheads Cost AccountingDate recorded: 22 Mar 2016 Should net proceeds reduce the cost of PPE? — Agenda paper 2 Recap The IFRS Interpretations Committee received a request to clarify the accounting for net proceeds from selling items produced while testing an item of property, plant and equipment (PPE) under constructionIAS 16 — Accounting for proceeds and costs of testing of PPETo understand accounting for material variances, we need to know how transactions relating to materials are recorded in cost accounting Of the transactions relating to materials, the ones involving purchases and returns of materials are financial accounting transactions which are also considered in cost accounting and the ones relating to consumption of materials are exclusive Material Variances Cost Accounting Treatment

.jpg)

Treatment of warehousing and similar costs Accounting Guide

Some costs are easy to identify as those which can be capitalized as part of inventory costs because they are clearly related to the manufacturing process This is the case with direct costs and some indirect costs Other costs are not as easy to analyze from the standpoint of inventory capitalization In this article we will look at such costs and whether they should be included in Inventory registration accounts follows the production process from the delivery of raw materials through their transformation into finished products that are ready for saleTypes of Inventory in a Accounting Treatments for Different Kinds of Inventory; Although the term “transfer” is used for flour instead of buying and selling, Accounting Treatments for Different Kinds of InventoryProcurement Resource provides indepth cost analysis of Limestone production, including manufacturing process, capital investment, operating costs, and financial expenses +1 307 363 1045 sales@procurementresource Limestone plays an important role in environmental applications, such as water treatment and acid mine drainage mitigationLimestone Production Cost Analysis Reports 2024 Procurement Cost of production, selling price, activity based costing, cost plus pricing The Indonesian government continues to strive to address malnutrition and reduce the prevalence of stunting from 216% ANALYSIS OF PRODUCTION COSTS AND DETERMINATION OF SELLING

Cost Accounting: Unit5 Cost Sheet Questions Answers PDF

2024年3月31日 1 Cost Accounting Acharya Institute of Graduate Studies III SEM, BBA Module 1 Introduction to Cost Accounting Cost sheet is defined by C1MA, UK as “a document which provides for the assembly of the detailed cost of a cost centre or cost unit” Thus cost sheet is a periodical statement of cost designed to show in detail the various elements of cost of goods This accounting treatment is highly objectionable 2 It may be deducted either from cost of production or cost of sales 4 Credit of ByProduct Value less Administration, Selling and Distribution Costs: In this method, the sales value of the byproduct, ByProducts: Meaning and Accounting Cost AccountingDepletion Allowance: Limestone produced and used for lime production, 14% (domestic and foreign) Government Stockpile: None Events, Trends, and Issues: In 2023, domestic lime production was estimated to be unchanged from that in 2022 However, some of the lime producers have increased product pricing owing to increased costs of production Domestic Production and Use USGS Publications Warehouse2020年5月14日 Date recorded: 16 Jul 2014 The project manager introduced the paper based on a request for clarification received by the IC for the accounting for net proceeds received during the course of testing an item of property, plant and equipment (PPE), in the case that the net proceeds exceed the costs of testingIAS 16 — Accounting for net proceeds and costs of testing on

Production Overhead Accounting

The below mentioned article provides a note on production overhead The production cost is inclusive of all direct material, direct labour, direct expenses and manufacturing expenses The manufacturing expenses is inclusive of all indirect materials, indirect labour and indirect expenses concerned with manufacturing activity which starts with supply of materials and ends with 2024年2月1日 Solution Investment property is initially measured at the cost of C105, including the transaction costs of C5 [IAS 40 para 20]Transaction costs include legal fees, property transfer taxes etc that are directly attributable to the acquisition of the property [IAS 40 para 21]However, investment property measured subsequently at fair value cannot be stated at an 241 Accounting for transaction costs, startup costs andASU 201902 for film and television production cost accounting and highlights key accounting issues and potential challenges for media and entertainment (ME) entities that account for film and television production costs under US GAAP There have been significant changes within the ME production and distribution modelsImprovements to Accounting for Costs of Films and License 2020年8月12日 Accounting for film production costs may lead to some unpredictable outcomesFind our the complete Accounting for Film Production Cost ; ; Login Company About Us; Partner With Us; Career; Learning; Our Team; The most appropriate treatment is to recognise the intangible asset less costs to sell or Synopsis on Accounting for Film Production Cost Enterslice

.jpg)

CAS 24 COST ACCOUNTING STANDARD ON TREATMENT OF REVENUE IN COST

• para 56 of CAS13, Cost Accounting Standard on Cost of Service Cost Centre; • para 513 of CAS14, Cost Accounting Standard on Pollution Control Cost; • para 55 of CAS15, Cost Accounting Standard on Selling and Distribution Overheads; • para 54 of CAS17, Cost Accounting Standard on Interest and Financing Charges;Keywords: Cost Accounting, Cost of Production, Selling Price, Full Costing Method, Cost Plus Pricing Method 1 INTRODUCTION The development of Micro, Small, and Medium Enterprises (MSMEs) in treatment of fixed production costs behave In full costing overhead costs bothUSING COST ACCOUNTING AS THE BASIS FOR SELLING PRICE to the future benefits Future costs may include production, selling and administration costs and additional research and development costs 16 The nature of most research and development activities is such that at the time costs are incurred the amount and timing of future benefits may be too improbable to justify deferral However, thereAccounting for Research and Development CostsThe following points highlight the twenty six items of expenses Some items are: 1 Design and Drawing Office Costs 2 Materials Carriage, Handling and Storage Expenses 3 Transport Charges 4 Royalties and Patent Fees 5 Light, Heat and Airconditioning 6 Repairs Renewals and Maintenance 7 Material losses and Wastages 8 Inspection Charges 9 Insurance Costs Treatment of Items of Expenses: 26 Items Cost Accountancy

The four major costs associated with cement

1 Power and fuel cost 2 Raw material cost 3 Selling expenses 4 Other expenses 1 Power and fuel The cement industry is powerintensive, with power and fuel cost accounting for around 2530 per cent of the total cost of sales of 2019年4月3日 Cost of Goods Sold (COGS) is the cost which is directly attributable with the cost of production against product sales The expenses included in the Cost of Goods sold are Raw Materials, Packaging Materials, Cost of Goods Sold : Accounting Treatment, Methods Physical measures are useful Chapter 11 Allocation of Joint Costs and Accounting for ByProduct/Scrap 483 Exhibit 11–5 Joint Cost Information for Harkins Poultry Joint processing cost for period: $5,400,000 (1) (2) Tons Produced (3) Sales Price per Ton at SplitOff (4) Marketing Cost per Ton Regardless of When Sold (5) Separate Cost per Ton If Processed Further (6) Allocation of Joint Costs and Accounting for ByProduct/ScrapIn this article we will discuss about the treatment of special items of overheads in cost accounts Material Handling Expenses: These expenses are incurred while unloading the raw materials received from supplier, storing the raw materials, handling the raw materials to work place, handling of workinprogress, storage of finished goods etc It also includes costs incurred for Treatment of Special Items of Overheads in Cost Accounts

Research Cost: Meaning and Treatment Overheads Accounting

In this article we will discuss about the meaning and treatment of research cost Meaning of Research Cost: The research expenditure is the cost of searching for new products, new manufacturing process, improvement of existing products, processes or equipment The development expenditure is the cost of putting research result on commercial basis Some of 2010年8月26日 IFRIC 20 considers when and how to account separately for the benefits arising from the removal of mine waste materials ('overburden') to gain access to mineral ore deposits, as well as how to measure these benefits both initially and subsequently IFRIC 20 was issued on 19 October 2011 and applies to annual periods beginning on or after 1 January 2013IFRIC 20 — Stripping Costs in the Production Phase of a Surface 2009年11月5日 The IFRIC considered four alternatives on accounting for stripping costs during production: expense when incurred ; capitalise as a cost of inventory as variable production cost (the US approach) capitalise and attribute to reserves benefited in a systematic and rational manner (the Canadian approach) capitalise using a strip ratioIAS 16 — Accounting for stripping costs in the production Accrual accounting is based on the principle that revenues are recognized when earned (a product is sold or a service has been performed), regardless of when cash is received For instance, assume a company performs services for a customer on accountIntroduction to Revenue Recognition – Financial Accounting

.jpg)

IAS 27 — Treatment of transaction costs on acquisition or

2009年5月7日 IFRS 3 — Acquisitionrelated costs in a business combination; IFRS 3 — Earlier application of revised IFRS 3; IAS 27 — Treatment of transaction costs on acquisition or disposal of noncontrolling interests; IAS 28 — Potential effect of IFRS 3 (as revised in 2008) and IAS 27 (as amended in 2008) on equity method accounting