Machinery factory cost accounting table

Manufacturing Accounts Accounting Tuition

A manufacturing account shows the cost of running and maintaining the factory It is prepared to calculate the cost of goods produced during the year and it is also known as the production account Cost of production includes direct cost and indirect costMontagne Blanche, Mauritius +2305786 5370 mrking786@gmail; Contact ContactIn short, machine hour rate means the factory expenses incurred in running a machine for an hour The machine hour rate is calculated by dividing the total amount of factory overheads Machine Hour Rate: Meaning, Types and Computation Cost 2024年3月25日 The machine hour rate is essentially the cost of running a machine for one hour It includes all the associated expenses from electricity and maintenance to depreciation and StepbyStep Guide to Computing Machine Hour Rate

A Deep Dive into Manufacturing Cost Analysis Accounting

Manufacturing cost analysis is a critical subset of cost accounting that focuses on evaluating and breaking down all the costs involved in producing goods Manufacturers get valuable insights Pi plc manufactures 2 products, A and B The cost cards are as follows: The total hours available are 48,000 3 Throughput Accounting The key factor approach described in the previous ACCA F5 S16 Notes OpenTuitionAccounting for manufacturing costs requires tracking and valuing these inventories using methods such as the moving average cost or the firstin, firstout (FIFO) method This enables Manufacturing Accounting: The Ultimate Guide (2024) — Katana2024年3月21日 They follow certain best practices, such as cost accounting methods focusing on manufacturing costs This includes tracking direct costs like materials and labor and tricky The Complete Guide to Accounting for Your Manufacturing

.jpg)

Total Manufacturing Cost: Formula, Guide, How to Calculate

2020年9月1日 To calculate total manufacturing cost you add together three different cost categories: the costs of direct materials, direct labour, and manufacturing overheads 2023年3月3日 Factory cost: Results from the prime cost plus the factory overhead (or works overhead) and comprises the aggregated direct material cost, direct labor cost, direct expenses, and factory overhead Factory cost is also known as works cost, production cost, or manufacturing cost Office cost: Results from the factory cost plus the office and Elements and Components of Cost Definition and Formula2024年4月5日 Now that we understand the components of factory cost, let’s look at how to calculate it The formula for calculating factory cost is: Factory Cost = Prime Cost + Factory Overheads Let’s break this down further with an example to make it clearer Example: Calculating factory cost 🔗 Imagine a company, ABC Manufacturing, that produces Calculating Factory Cost in Unit Costing InstituteAccounting for Factory Overhead Free download as Powerpoint Presentation (ppt), PDF File (pdf), Text File (txt) or view presentation slides online This document discusses accounting for factory overhead costs It covers Accounting For Factory Overhead PDF Factory

.jpg)

Factory Accounting PDF Overtime Expense

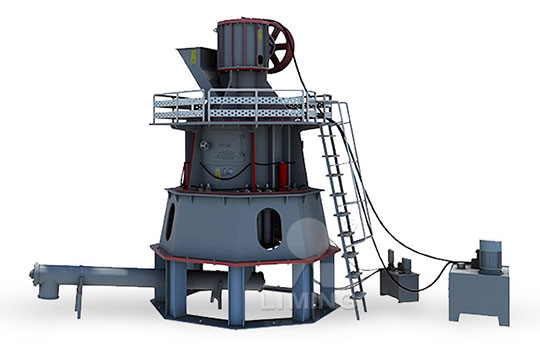

FACTORY ACCOUNTING Free download as PDF File (pdf), Text File (txt) or read online for free The document defines various accounting terms used in factory accounting like acceptance of tender, adjustment voucher, analytical statement, annual store account, bin card, danger level, day work card, demand note, estimating, except system, extract, indent, inter factory demand, 1 Meaning of Machine Hour Rate: Machine hour rate method is one of the methods of absorption of factory overheads into production In industries like chemicals, engineering, steel and other heavy industries where the work is done mostly by machines, it is desirable to adopt the machine hour rate method for the absorption of factory overheads, because, in such industries, factory Machine Hour Rate: Meaning, Types and Computation Cost Accounting2024年6月28日 In accounting, cost driver rates play a crucial role in determining the allocation of costs to different activities or products within an organization These rates help businesses understand the relationship between the cost of resources used and the activities that drive those costs By accurately identifying and measuring cost drivers, companies can gain valuable Accounting for Equipment Depreciation with Cost Driver RatesCost Acc Chapter 8 Free download as Word Doc (doc / docx), PDF File (pdf), Text File (txt) or read online for free This document discusses budgeting and allocating factory overhead costs It covers: 1) Classifying overhead costs as fixed, variable, or mixed and preparing flexible budgets 2) Factors to consider in computing an overhead rate such as the base used, activity level Cost Acc Chapter 8 PDF Cost Factory

Indirect factory costs definition — AccountingTools

2024年6月14日 What are Indirect Factory Costs? Indirect factory costs are all costs incurred by a manufacturing operation, not including direct materials and direct laborThese costs are allocated to the units produced within the same period If the units are not sold, then the allocated costs are included in ending inventoryIf the units are sold, then the associated cost allocation Subject Accounting Factory Overhead Allocations Cost Driver Chisholm Institute of TAFE; Diploma of Accounting; Machine Dep Value of machinery $80,000 $15,000 Complete the allocation of Service Department table that follow by allocating the Service Department costs to the producing departments Subject Accounting Factory Overhead Allocations Cost DriverManufacturing Overhead: Indirect factoryrelated costs that are incurred to produce a product, such as maintenance of equipment, factory rent, and utilities Is depreciation a period cost? Depreciation can be both a product cost and a period cost, depending on the use of the assets being depreciatedProduct and Period Cost Classification in AccountingExamples of Overhead Costs: 1 Manufacturing Overhead 2 Administration Overhead 3 Selling and Marketing Overhead Costs 4 Distribution Overheads 5 Research and Development Costs 6 Fixed Overhead Costs 7 Variable Overhead 8 SemiVariable Overhead Costs 9 Indirect Materials Cost 10 Indirect Labour Cost 11 Indirect Expenses 1 Manufacturing Overhead: Examples of Overhead Costs: Top 11 Examples Cost Accounting

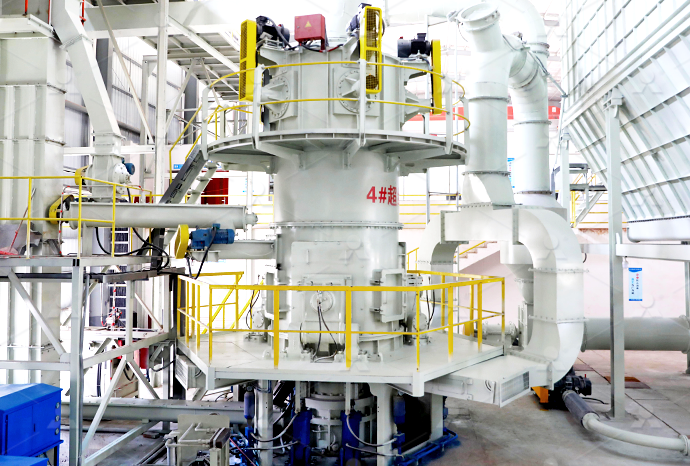

What Are the Major Operating Costs of Cement Plants?

2024年12月1日 Transportation and Logistics Costs: These costs are crucial, often accounting for 510% of the budget, emphasizing the importance of logistics in cement production Depreciation Costs: A significant fixed expense, typically around 510% , impacting the overall financial assessment of the plantThe below mentioned article provides a note on production overhead The production cost is inclusive of all direct material, direct labour, direct expenses and manufacturing expenses The manufacturing expenses is inclusive of all indirect materials, indirect labour and indirect expenses concerned with manufacturing activity which starts with supply of materials and ends with Production Overhead AccountingMetal used in manufacturing tables 2 Insurance on factory machines 3 Leather used in manufacturing furniture 4 Wages paid to machine operators 5 Depreciation of factory machinery 6 Salaries of factory supervisors 7 Wood used in manufacturing furniture 8 Cost Accounting Chapter 2 Assessment Chapter 2 CostIt is costly to (1) come up with the cost pools, (2) determine how much overhead cost goes into each cost pool, and (3) update the cost pools and firststage allocation numbers over time Thus ABC usually isn’t implemented by smaller firms or firms that don’t have especially inaccurate joborder costing numbers (see Section 51)5: ActivityBased Costing Open Cost Accounting

.jpg)

Solution guide for Cost Accounting

Problems and their solution for Cost Accouting chapter cost concepts, classifications and accounting cycle summary of answers exercise 10 administrative Skip to C g P55 000 (below, Table 1) 7 B 17 C 27 D h P15 000 8 B 18 C 28 A i P148 500 9 B 19 D 29 C Total factory costs P Total factory costs P WIP, beg 2024年3月31日 Cost Accounting: Unit5 Cost Sheet Questions Answers Download as a PDF or view online for free Cost Accounting: Indirect wages 16,000 Repairs of plant machinery 42,400 Factory rent , rates and taxes 12,000 Depreciation of plant machinery 28,900 Electricity charges 48,000 Fuel 64,000 Manager’s salary Cost Accounting: Unit5 Cost Sheet Questions Answers PDFCOST ACCOUNTING 205 Illustration 2 : Pass the journal entries for the following transactions in a double entry cost accounting system: Particulars ` a) Issue of material : Direct 5,50,000 Indirect 1,50,000 b) Allocation of wages and salaries : Direct 2,00,000 Indirect 40,000 c) Overheads absorbed in jobs : Factory 1,50,000 Administration 50,000COST ACCOUNTING 201Manufacturing cost is one of the most important aspects of running a business, and it can mean the difference between success and failure Whether in retail or manufacturing, knowing how to calculate your manufacturing costs will help you understand where you stand regarding profitability and how to improve it Manufacturing a product comprises labor, materials, and What Is Manufacturing Cost? Accounting Professor

.jpg)

Alternative to Distortions Created by Traditional Cost Accounting

The two hypotheticals firms, “P” and “Q” shown in Table 3 have the same revenues, costs and are operating in the same environment with similar business models and productmix, the difference is that “P” uses cost accounting and “Q” uses throughput accountingSemivariable Factory Overhead Cost, is a factory overhead cost that changes not in proportion to changes in the volume of activity For the purposes of determining factory overhead rates and for FACTORY OVERHEAD COST BUDGET ResearchGateFactory overhead is a term used in accounting to describe the indirect costs of operating a manufacturing plant or factory These costs are incurred during the production process but are not directly associated with the production of a What is Factory or Manufacturing Overhead? – Chapter 3 Cost Accounting Cycle It is composed of theories and indirect labor, and other manufacturing expenses, such as depreciation on the factory building, machinery and equipment, supplies, heat, light, power, maintenance Chapter 3 Cost Accounting Cycle Chapter 3: Cost

Accounting For Factory Overhead PDF Cost Of Goods Sold

– Accounting for Factory Overhead Free download as Word Doc (doc / docx), PDF File (pdf), Text File (txt) or read online for free This learning material provides the learner about the third component of product cost – manufacturing overhead2020年5月7日 Cost accounting systems are designed to accumulate, following table: account were undercharged for the costs of factory overhead incurred in the accounting period(PDF) Cost Accounting Accounting for F O H ResearchGatefactory overhead ssc cost accounting and controlaccounting for manufacturing overhead oriented, related to operation of machinery, then the most appropriate base will be machine The simplest of all bases is physical output or units of production Illustration 01 : The Salazar Round Table Company estimates factory overhead at P450 FOH factory overhead Accounting for FactoryAn assignment on accounting related subject accounting for factory overhead multiple choice: on Electricity to power machinery b Factory supplies c Rental of factory Human Res Direct labor costs: $475,000 $438, Direct material costs: $632,000 $527, Factory overhead costs: $750,000 $832,000 $75,000 $50,000 $30, Direct labor Acctg An assignment on accounting related subject

Total Cost of Manufacturing Raw Cost, Direct Labor, Overhead

2023年4月13日 The total cost of manufacturing a product has three elements, namely: Raw materials used (or direct materials cost); Direct labor (or direct wages) Production overhead (or factory overhead or works overhead); A manufacturing business maintains separate raw materials purchase accounts for each type of raw material that its factory usesProperty taxes on factory$6,000 4 Accounting staff salaries$35,000 5 Drum [TABLE] The following costs result from the production and sale of 4,000 drum sets manufactured by Vince Drum Factory utilities $85,000 Factory foremen salaries $87,000 Machinery setup costs $31,000 Total manufacturing overhead $203,000 ; Billy Listed here are the total costs associated with the 2015 MAIN ELEMENTS OF COSTS 461 Elements of Cost There are three main elements of cost 1 Material 2 Labour 3 Expenses 1 Material Cost It is the cost of material which is used for the production of the product It can be Raw material, component assembly, oils, lubricant, stationary printing, packaging etc The material can be of two types Financial Management Cost Accounting eKrishi Shiksha2023年3月3日 Factory cost: Results from the prime cost plus the factory overhead (or works overhead) and comprises the aggregated direct material cost, direct labor cost, direct expenses, and factory overhead Factory cost is also known as works cost, production cost, or manufacturing cost Office cost: Results from the factory cost plus the office and Elements and Components of Cost Definition and Formula

.jpg)

Calculating Factory Cost in Unit Costing Institute

2024年4月5日 Now that we understand the components of factory cost, let’s look at how to calculate it The formula for calculating factory cost is: Factory Cost = Prime Cost + Factory Overheads Let’s break this down further with an example to make it clearer Example: Calculating factory cost 🔗 Imagine a company, ABC Manufacturing, that produces Accounting for Factory Overhead Free download as Powerpoint Presentation (ppt), PDF File (pdf), Text File (txt) or view presentation slides online This document discusses accounting for factory overhead costs It covers Accounting For Factory Overhead PDF FactoryFACTORY ACCOUNTING Free download as PDF File (pdf), Text File (txt) or read online for free The document defines various accounting terms used in factory accounting like acceptance of tender, adjustment voucher, analytical statement, annual store account, bin card, danger level, day work card, demand note, estimating, except system, extract, indent, inter factory demand, Factory Accounting PDF Overtime Expense1 Meaning of Machine Hour Rate: Machine hour rate method is one of the methods of absorption of factory overheads into production In industries like chemicals, engineering, steel and other heavy industries where the work is done mostly by machines, it is desirable to adopt the machine hour rate method for the absorption of factory overheads, because, in such industries, factory Machine Hour Rate: Meaning, Types and Computation Cost Accounting

Accounting for Equipment Depreciation with Cost Driver Rates

2024年6月28日 In accounting, cost driver rates play a crucial role in determining the allocation of costs to different activities or products within an organization These rates help businesses understand the relationship between the cost of resources used and the activities that drive those costs By accurately identifying and measuring cost drivers, companies can gain valuable Cost Acc Chapter 8 Free download as Word Doc (doc / docx), PDF File (pdf), Text File (txt) or read online for free This document discusses budgeting and allocating factory overhead costs It covers: 1) Classifying overhead costs as fixed, variable, or mixed and preparing flexible budgets 2) Factors to consider in computing an overhead rate such as the base used, activity level Cost Acc Chapter 8 PDF Cost Factory2024年6月14日 What are Indirect Factory Costs? Indirect factory costs are all costs incurred by a manufacturing operation, not including direct materials and direct laborThese costs are allocated to the units produced within the same period If the units are not sold, then the allocated costs are included in ending inventoryIf the units are sold, then the associated cost allocation Indirect factory costs definition — AccountingToolsSubject Accounting Factory Overhead Allocations Cost Driver Chisholm Institute of TAFE; Diploma of Accounting; Machine Dep Value of machinery $80,000 $15,000 Complete the allocation of Service Department table that follow by allocating the Service Department costs to the producing departments Subject Accounting Factory Overhead Allocations Cost Driver

Product and Period Cost Classification in Accounting

Manufacturing Overhead: Indirect factoryrelated costs that are incurred to produce a product, such as maintenance of equipment, factory rent, and utilities Is depreciation a period cost? Depreciation can be both a product cost and a period cost, depending on the use of the assets being depreciated